Crude Awakening

Oil prices became the main topic that closed 2014 and the main topic to begin 2015. Many people are facing up to the crude awakening of a consistent drop in world oil prices in a manner never seen before.

The oil industry, with its history of booms and busts, appears to be in the latent stages of its latest downturn. Since June 2014 the price of oil has plunged more than 55% to $47 a barrel as at the second week of January 2015; that is the lowest price since the depth of the 2009 recession.

Oil analysts predict that the price could fall below $40 before it rebounds. The fall of oil prices has been so steep that not a business day goes without mention of a new drop in price, prompting business people and decision makers to wonder how suddenly unpredictable the terrain has become and they are taking measures to counter the numerous challenges posed by the fall in price.

Slippery Slide

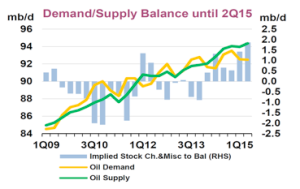

The key factor causing the continuous slide in the price of oil is demand and supply economics. Supply has outstripped demand since the third quarter of 2013. Global Demand (long term) and specifically from China is low because of weak economic activity. China’s opening to world trade was responsible for lifting the oil price from around $20 a barrel to around $100. This price move correlates approximately with China joining the World Trade Organization at the beginning of the last decade; in which period, China alone added the equivalent of Japanese and U.K. total oil consumption to existing demand.

Even though China’s oil imports reached seven million barrels for the first time in December 2014, oil product demand is slowing as Chinese consumption becomes more efficient and less oil intensive. China’s appetite for crude imports will also plateau once it completes building its Strategic Petroleum Reserves.

A second factor is that, the United States has suddenly become the world’s largest oil producer. Though it does not export crude oil, it now imports much less, creating a lot of spare supply. According to Energy Information Administration (EIA) data, the U.S. alone added nine million new barrels of crude oil per day to the global market in 2014 which is a considerable chunk of the global crude production of 91 million barrels per day.

The US continues to cut imports from OPEC and stopped importing crude from Nigeria all together. The downside of the US oil production is, it is relatively more expensive and analysts suggest that US shale oil production can only survive on $70 dollar per barrel, hence the current prices of oil makes the US production not competitive in the medium term.